We use cookies to improve your experience on our site. By using our site, you consent to the use of cookies. Rejecting cookies will prevent non-essential cookies from loading.

Customer Lifetime Value

Customer Lifetime Value (CLV): A Critical Metric for Building Strong Customer Relationships

Tracking customer lifetime value (CLV) helps you retain existing buyers and generate loyalty that lasts into future purchases.

If you are a software marketer, the last thing you would want is for your hard-earned clients to churn before you have had a chance to win their loyalty. Measuring customer lifetime value (CLV) can help you retain clients and ensure lasting relationships with them. As a matter of fact, 25% of marketers rank CLV among their top five marketing metrics [1] as it helps them assess and increase the efficacy of their outreach campaigns.

For software marketers focused on customer acquisition and lifecycle, CLV can assist in identifying your most valuable customers, and enable you to engage them with compelling offerings and incentives.

CLV gives a repeatable way to define high-value customers and drive retention efforts. In this article, we explore what is customer lifetime value and how it can help you better serve your customers.

Dive into more insights to attract and retain high-value customers with our on-demand webinar:

Understanding Software Buyer Regret: How to Reach the Right Customers and Avoid Churn

What is customer lifetime value (CLV)?

Customer lifetime value (CLV) is the total revenue or profit generated by a customer over the entire course of their relationship with your business. Simply speaking, it's a metric to measure the total

amount of money a software buyer has spent (or is expected to spend) on your products and services throughout their lifetime as a customer.

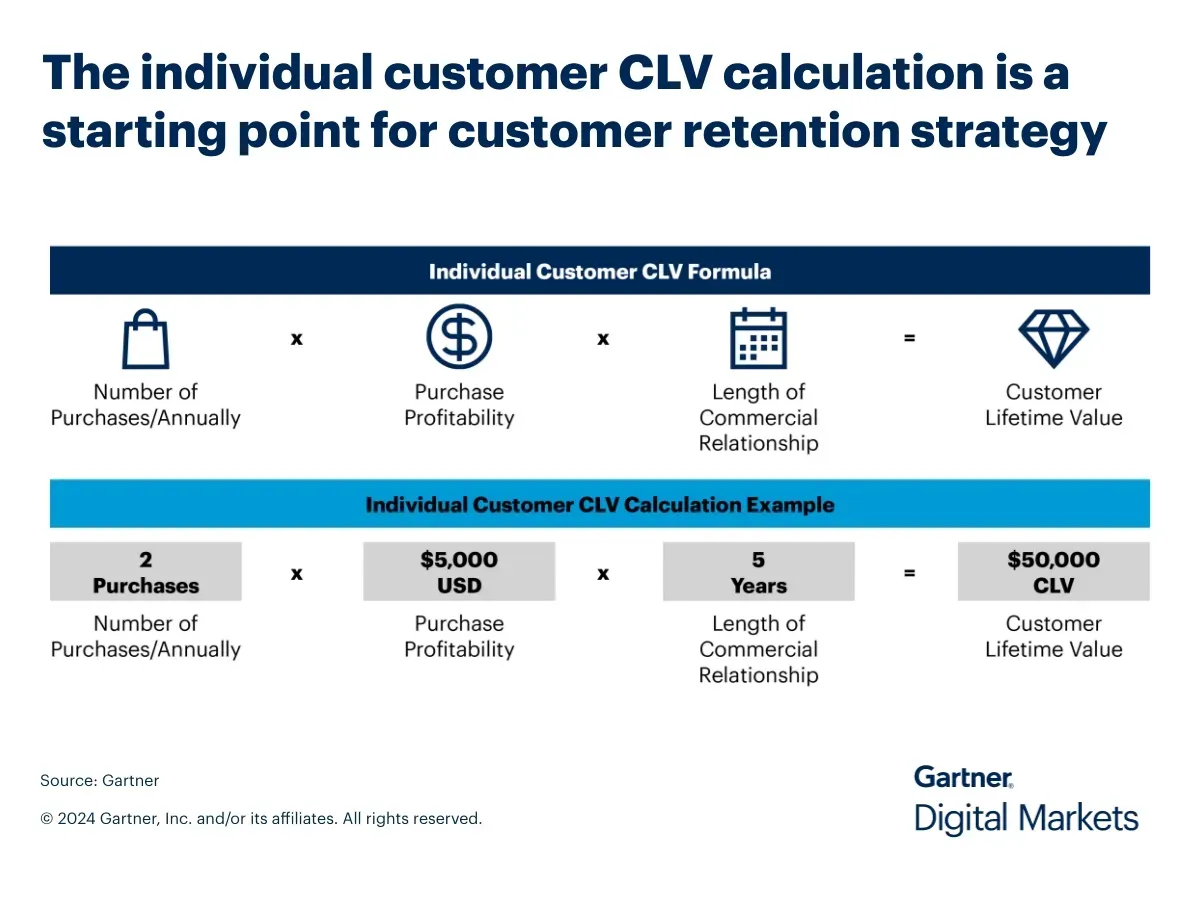

The higher the CLV, the more valuable a buyer is to your business, as they would generate more revenue and are more likely to be loyal. Here’s a quick preview of how to calculate CLV for an individual customer.

Pro tip:

Customers contribute to a business's revenue in

multiple ways. Direct purchases are an obvious source. Others include indirect contributions, such as referrals and word-of-mouth effects .Factoring in these networking effects to calculate CL V from a client can be challenging, which is why, start by focusing on revenue from sales and then work your way up to indirect contributions. To learn about more factors toconsi der when evaluating customer satisfaction, read our article on tracking your customer health score

.

Customer lifetime value (CLV) vs. Lifetime value (LTV): What’s the difference?

Often used interchangeably, lifetime value (LTV)

and customer lifetime value (CLV) have a key difference. LTV looks at the aggregate value of all customers, while CLV focuses on each customer’s worth to the business.

Calculating CLV gives you a holistic view of a customer's history with your company and pinpoints those most likely to buy from you again.

LTV, in contrast, provides a more general view of your overall customer base.

Four ways CLV informs marketing decisions

As businesses evolve, their software needs to also undergo changes. Our 2023 survey on Global Software Buying Trends revealed that a majority of buyers seek more software power—55% plan to

increase their number of licenses to accommodate more users and tasks while 50% plan to renew their subscription to an advanced version of software. Calculating CLV can help software marketers engage such software buyers in repeat business. Here are four ways calculating CLV benefits software marketers in their decisions.

1. Drive customer retention efforts

CLV can help you pinpoint customers at the risk of churning and timely deploy targeted retention strategies, ultimately reducing customer attrition

and encouraging repeat business.

Example: As a lifecycle marketer, you find that customers with longer software subscription plans bring higher customer value to your business. So, to encourage long-term engagement with software buyers, you introduce a customer loyalty program that rewards buyers with exclusive benefits, such as premium support, personalized onboarding, and discounted renewal rates.

2. Improve customer acquisition

Discover the marketing channels and strategies that attracted your current high-value customers by calculating their customer lifetime value (CLV). It’ll give you insights on how to reach new leads as well as potential loyal prospects.

Example: After calculating the CLV of customers acquired through various channels such as paid ads, social media, and referral programs, you find that customers acquired via referral programs have a higher CLV compared to others. So, you decide to invest more in referral programs to attract high-value customers.

3. Measure marketing effectiveness and return on investment (ROI)

By examining CLV growth, you can identify which campaigns generate the most favorable returns, ensuring that you allocate your budget to the most profitable initiatives.

Example: As a content marketer, you notice that a specific content piece has resulted in a significant increase in conversions and a higher CLV. In response, you can make a case for your marketing department to allocate more resources to refine that content strategy to enhance overall marketing ROI.

4. Create and prioritize customer segments

Using CLV data, you can generate distinct customer segments based on parameters such as spending value and engagement level. With this, you can create personalized campaigns tailored for each segment. You can customize messaging, offers, and promotions to deliver a more engaging customer experience for your prioritized segments.

Example: As a SaaS marketer, you use CLV data to segment customers into different tiers based on their spending value and engagement level. You then create a campaign targeting segments with higher spending and higher engagement, offering specialized promotions and personalized content to them.

Types of customer lifetime value data

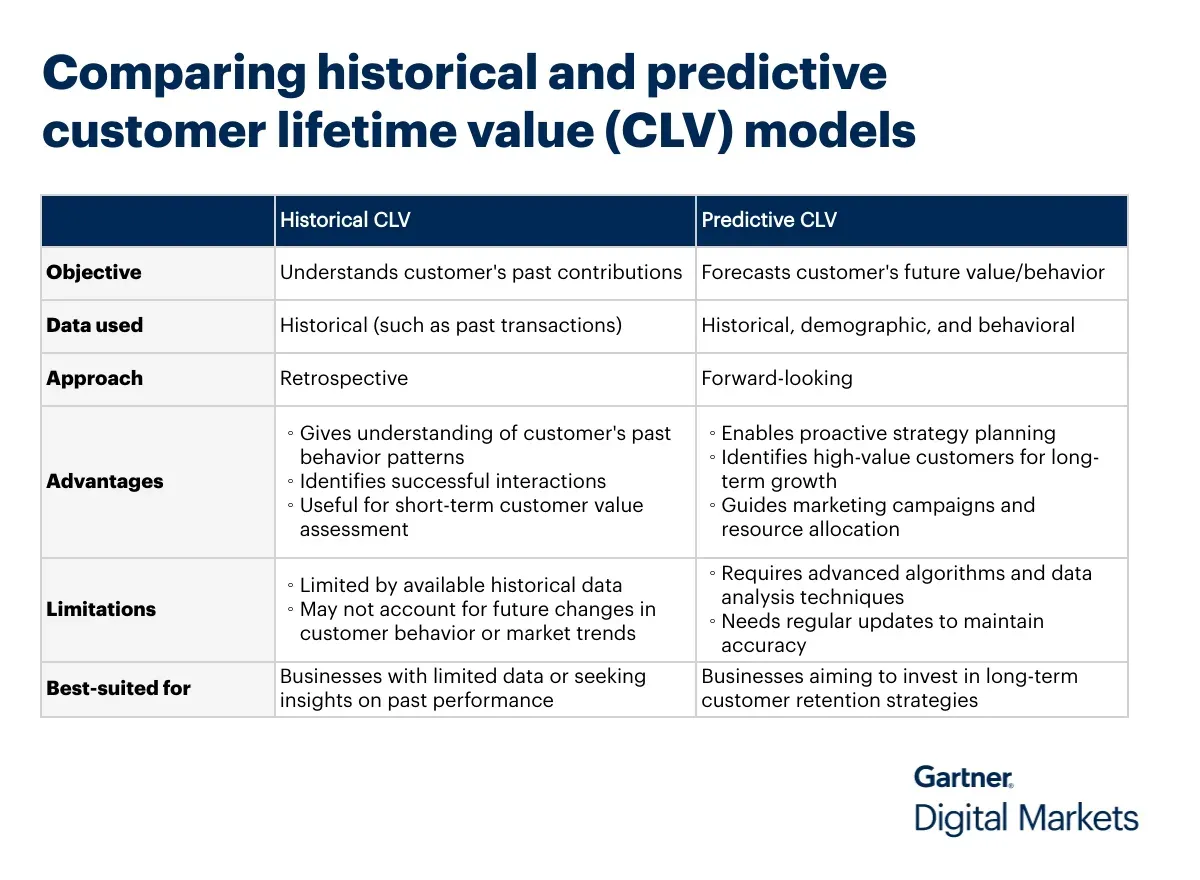

There are two broad dimensions to consider when calculating CLV: historical and predictive.

Historical CLV model looks at past data and makes a judgment on the value of customers based on previous transactions alone, without any attempt to predict what those customers will do next.

Predictive CLV model anticipates the future value of a customer by looking at historical data in the context of other factors, such as the recency of purchases and demographics (such as age, education, and country).

Both methods are useful for a business to understand the value of existing customers and their spending patterns. Look at the differences between these two.

Revenue or profit: What consistutes customer value for you?

The simple formula for calculating customer lifetime value is given by:

[Number of purchases x Value of purchase (in revenue or profit) x Average customer lifespan] = Customer lifetime value

One key factor to consider when deciding how to measure CLV is choosing between revenue (top line) or profit (bottom line) to calculate the value of purchase. For example, if you spend $1,000 to acquire a new customer and over the course of their relationship, the customer generates $2,000 in revenue. Using the top-line approach, CLV would be $2,000. However, using the bottom-line approach, it would be $1,000 ($2,000 in revenue minus $1,000 spent on customer acquisition).

Top-line calculation of CLV is simpler as customer-level revenue data is readily available. Bottom-line approach, though more accurate, is challenging to deploy as it considers the costs associated with

acquisition and serving a customer to determine profitability.

Tips for selecting the best approach to measure CLV:

Choose the bottom-line profit approach if direct costs vary noticeably across customers in your business and opt for the top-line revenue approach if differences in direct costs are minimal.

If you don’t have cost data established for individual customers, the top-line approach is a good starting point. Migrate to the bottom-line approach as you improve your ability of assigning costs to individual customers.

If you opt for the bottom-line approach to measure CLV, simplify the process of calculating the acquisition cost and serving a customer by limiting yourself to direct costs explicitly tied to them, such as discounts, service calls, and shipping and product returns.

Create more value for your customers with intent data

To drive up CLV, you need to create more value for your customers, which requires having a deep understanding of their needs and preferences.

Intent data can help you gain valuable insights into software buyers’ habits and interests and send personalized messaging and offerings to them.

Collect behavioral and contextual data of software buyers from their online interactions on software review websites Capterra, Software Advice, and GetApp with our intent data services. Our team of experts will deliver accurate, comprehensive, and real-time insights into your customers, helping you deepen your customer relationships beyond a single transactional interaction.

Learn what your customers are searching for and connect with in-market buyers seeking to replace software using our B2B intent data.